VWAP Indicators for thinkorswim

View all of our custom thinkorswim indicators, including one available for free.

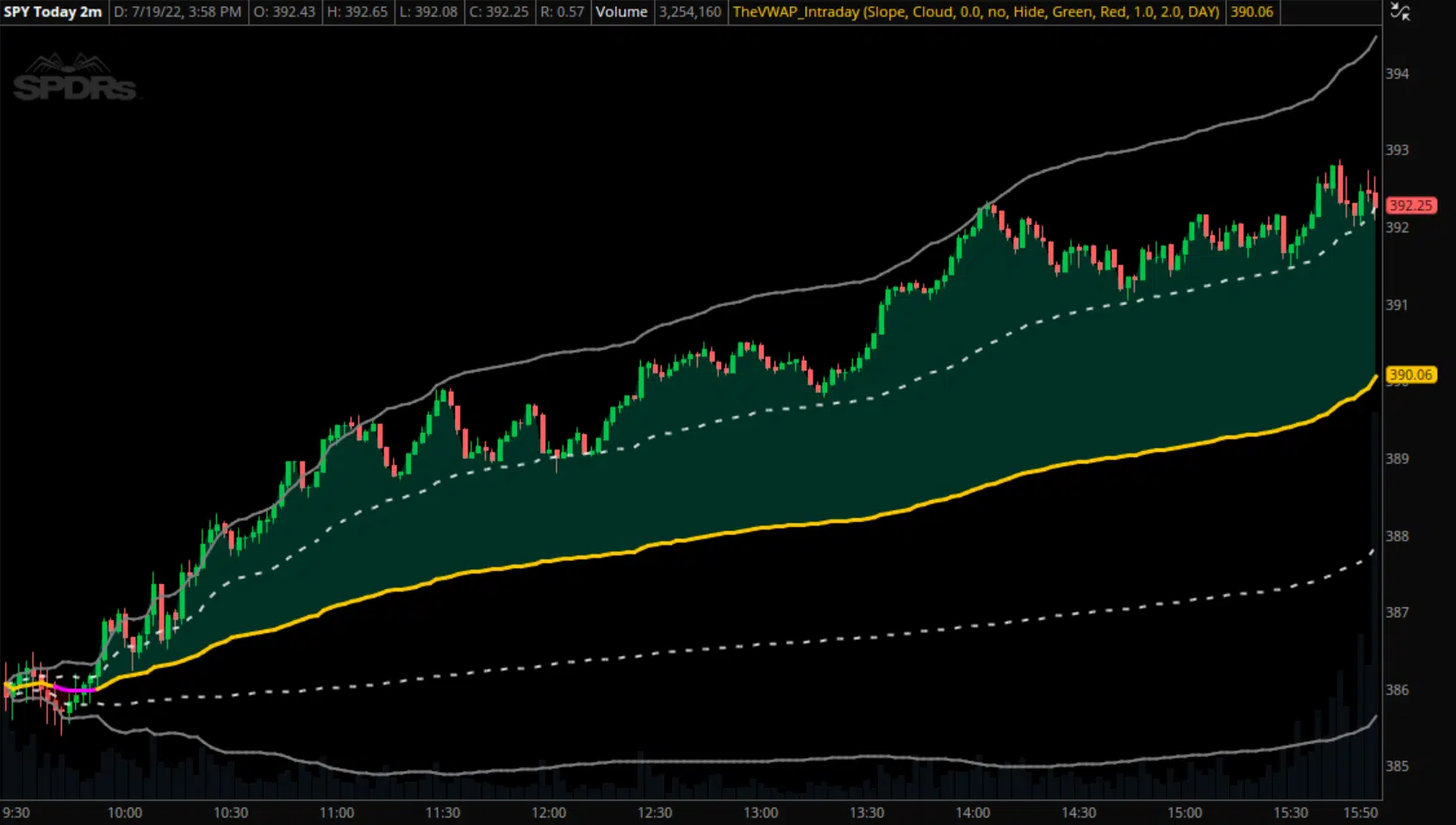

#1 — Intraday

Download our free intraday VWAP indicator for thinkorswim, which includes optional standard deviation

bands, an optimized user interface, and more.

Anchoring to the open of each market day by default, this indicator serves as an essential visual

reference point and is a core part of our framework for intraday trading.

Core features:

Multiple standard deviation band inputs

Dynamic color-coding for plots and clouds

Day, Week, or Month presets for VWAP length

Adjustable tolerance bands for zone buffers

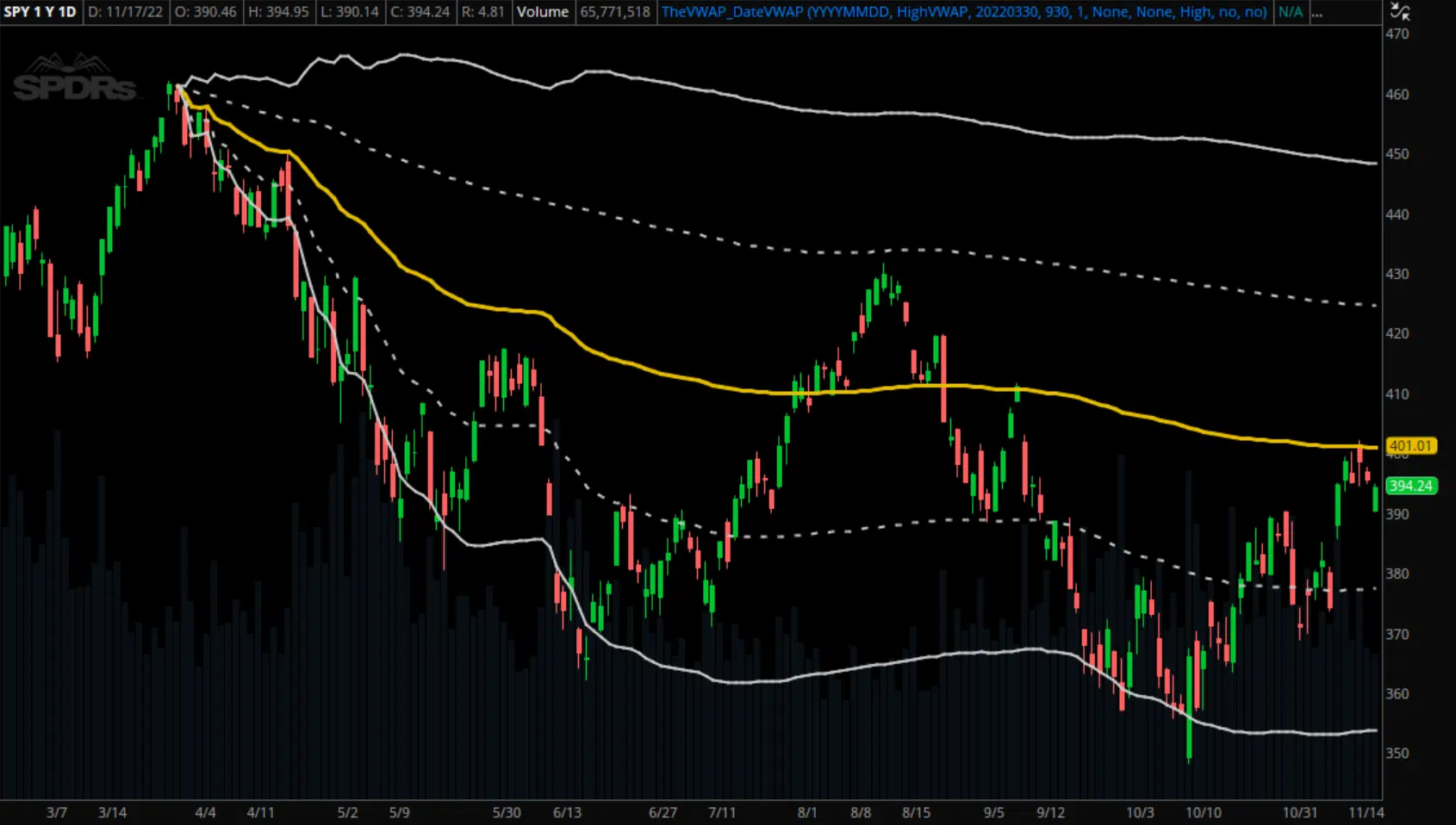

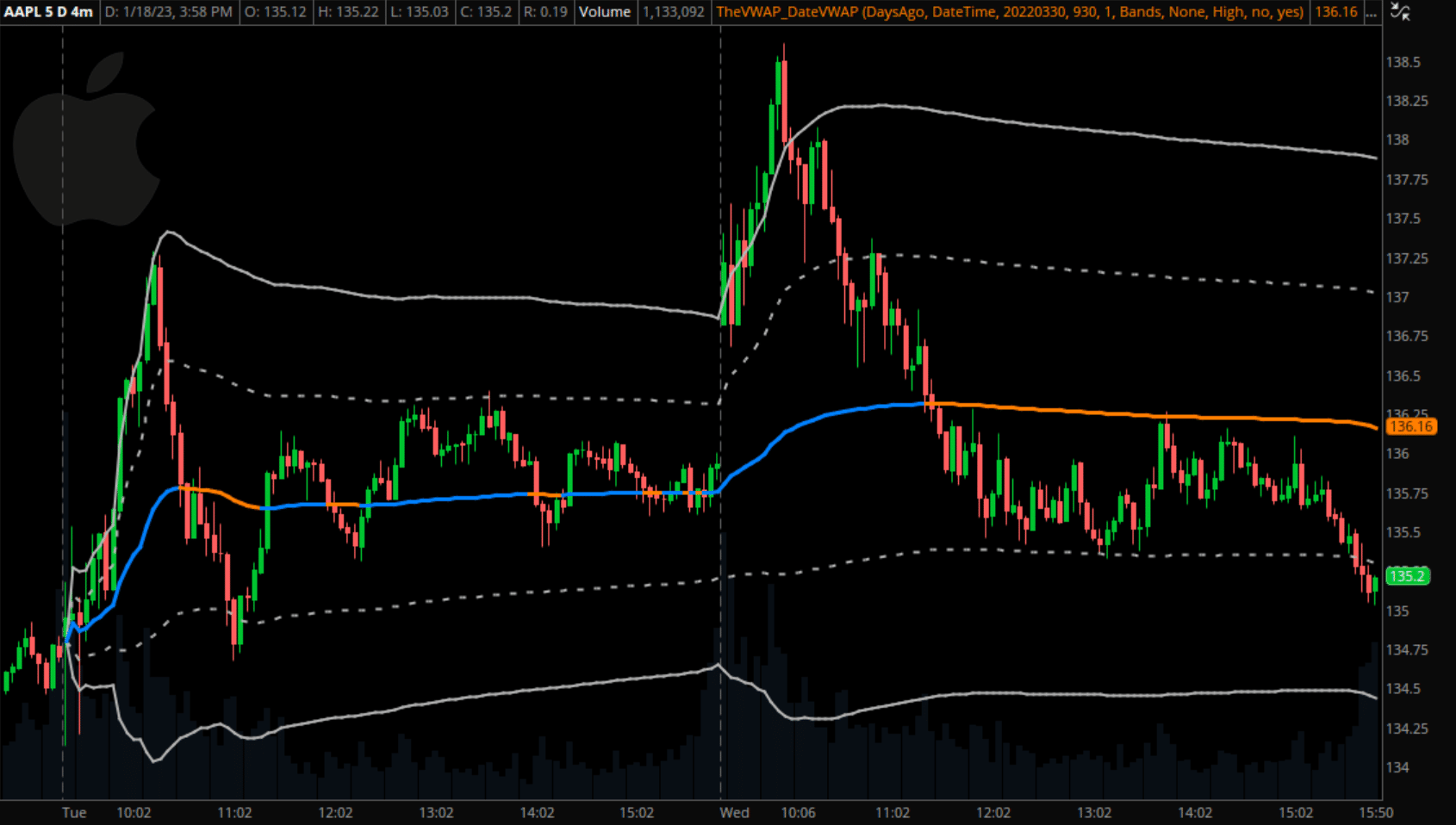

#2 — DateVWAP

Our all-in-one anchored VWAP tool for thinkorswim, which gives traders the ability to launch a VWAP and

optional standard deviation bands from any point in a chart's history.

By far our most powerful tool, DateVWAP includes multiple input options — YYYYMMDD HHMM, number of days

ago, or automatically identified highs and lows.

Core features:

Both manual and automatic input methods

Capability to plot standard deviation bands

Toggle on/off chart labels for quick analysis

Automatic preset to anchor to chart's IPO

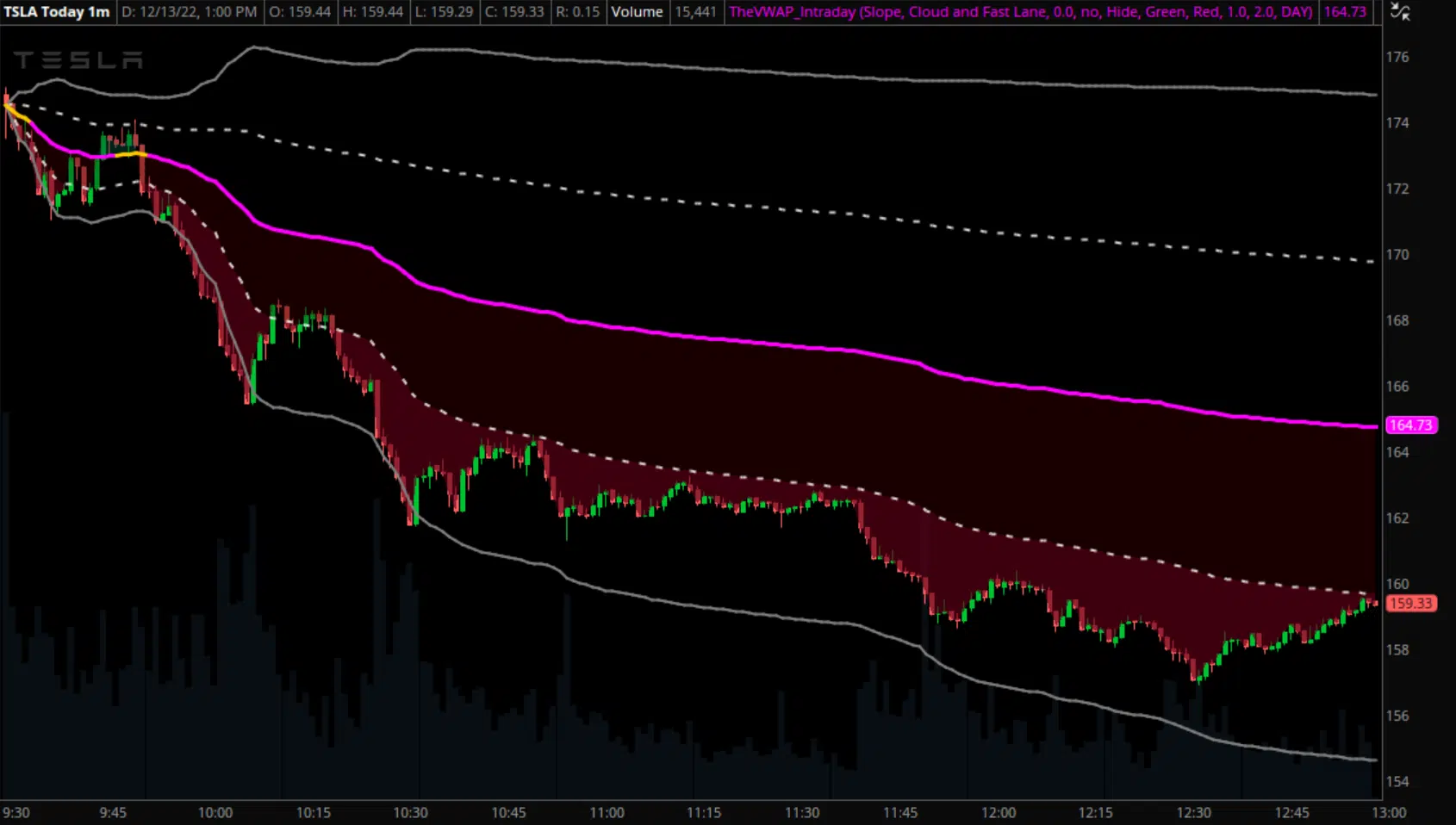

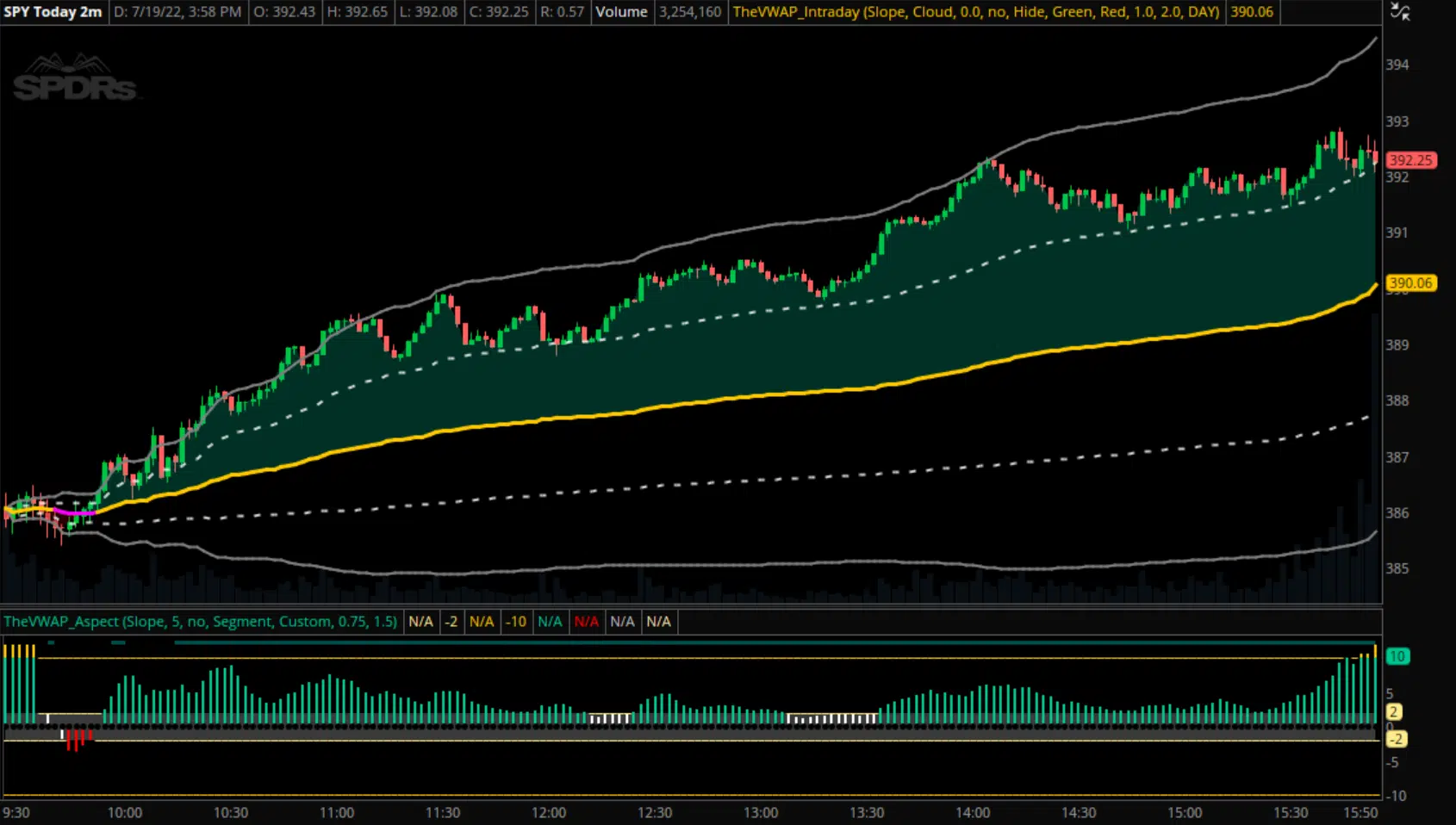

#3 — Aspect

Measure and monitor the slope of intraday VWAP to gauge the intensity of price moves in either

direction.

Aspect is first and foremost a confirmation tool that we utilize to help

assess the quality of potential setups and gauge the likelihood of their continuation as they develop.

Core features:

Adjustable lookback period for slope calculation

Sensitivity presets for different market types

Customizable sensitivity input for full user control

DevWidth and Position (Z-Score) modes

#4 — Dashboard

Just as the name implies, this indicator automatically calculate and displays several key VWAP metrics

in a consolidated dashboard.

When used in tandem with our free Intraday indicator, Dashboard allows traders to quickly assess a

chart's

volatility in the content of its intraday volume-weighted average price.

Core features:

Track deviation width and distance from VWAP ($ and %),

Position size calculator for rapid risk assessment

Compare current session's "VWAP move" to prior days

All metrics can be turned on/off by user

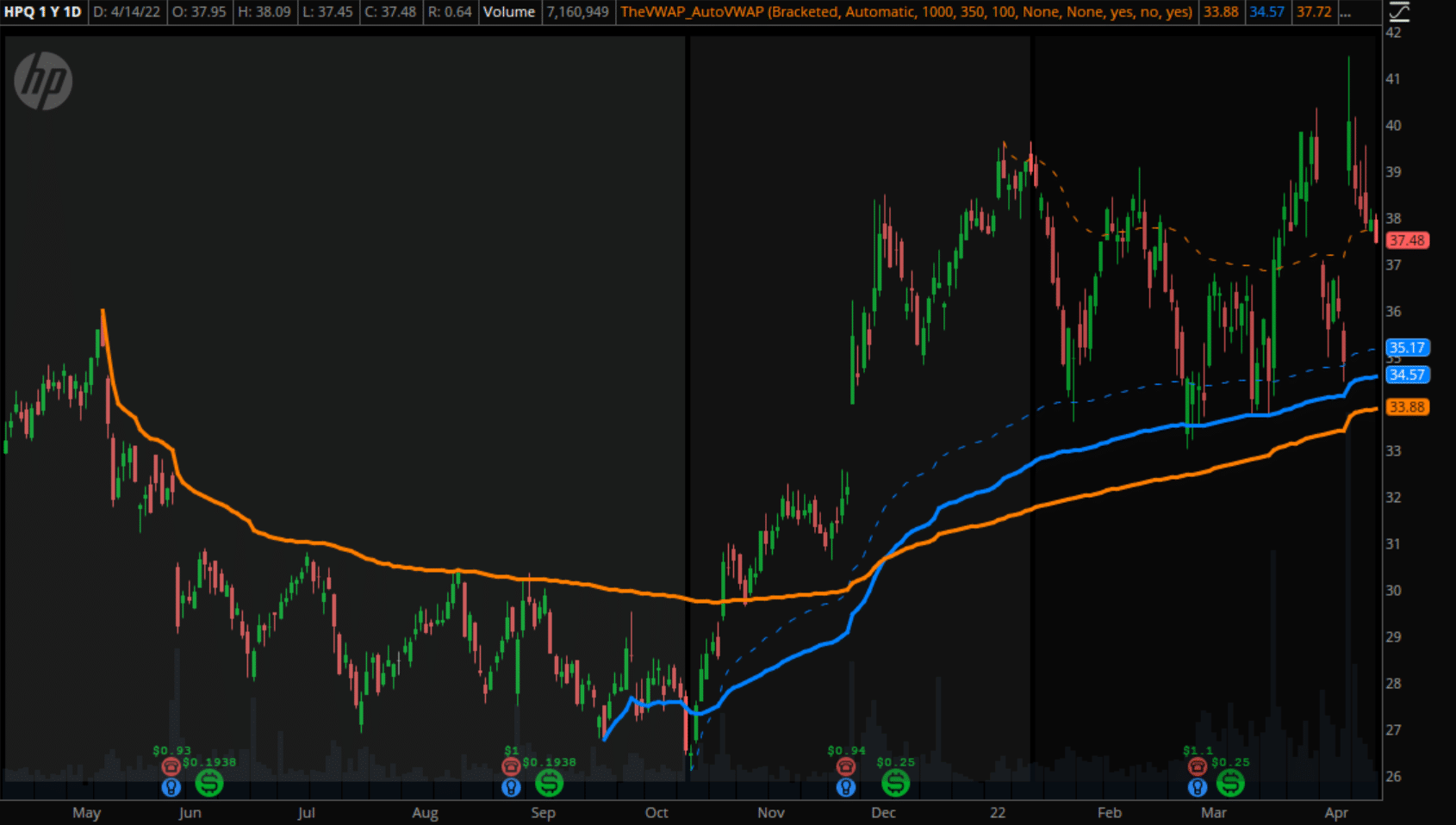

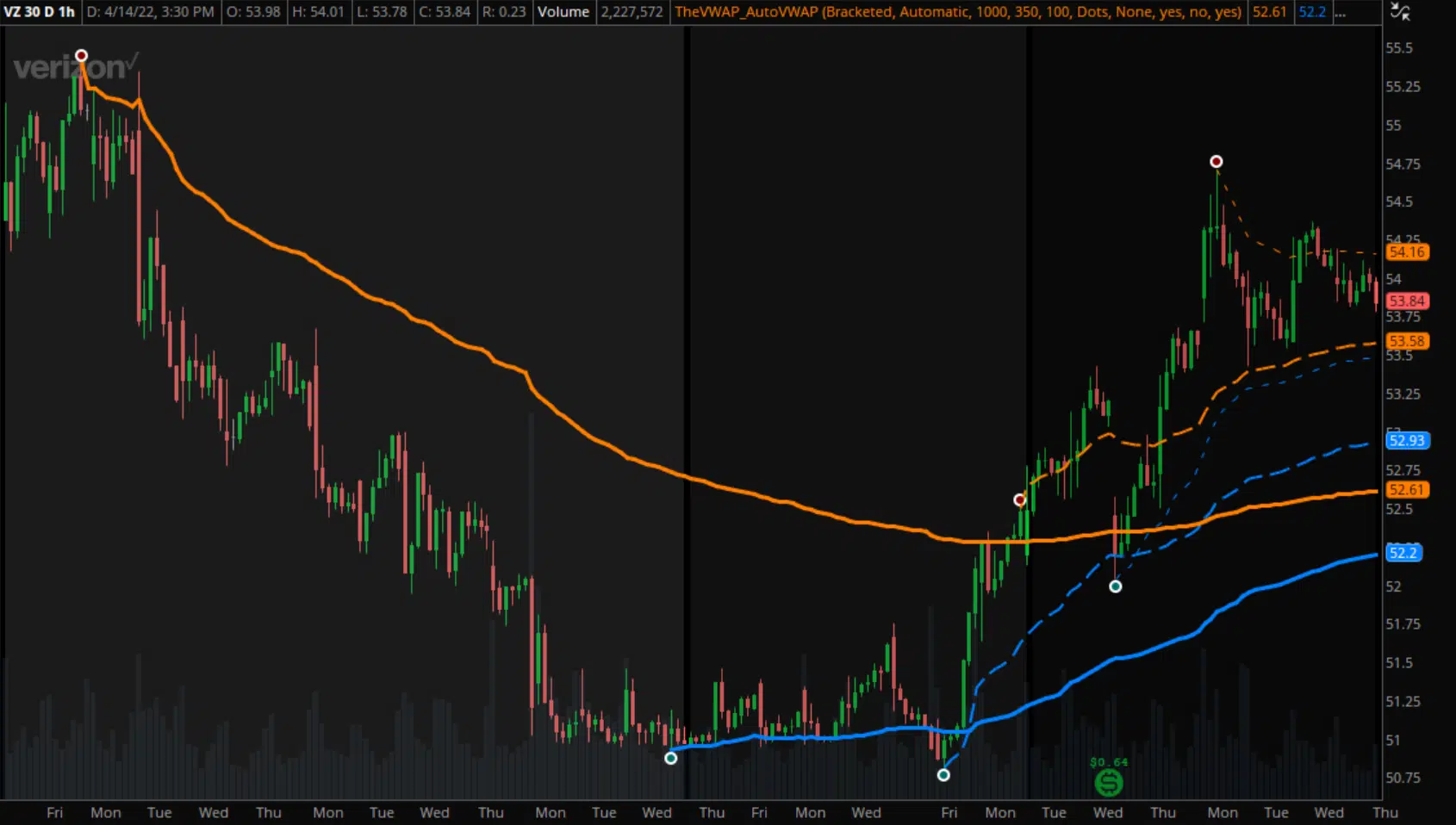

#5 — AutoVWAP

Another anchored VWAP indicator for thinkorswim, designed to automatically identify notable highs and

lows from any chart's history and launch VWAPs from those key levels.

AutoVWAP is designed to provide significant time savings and removes much of the guesswork typically

required when anchoring longer-term VWAPs.

Core features:

Automatic or Manual (find H/L within X bars) search methods

Option to visualize search zones and VWAP initiation points

Multiple highlight methods (line, dot, BarID) included

Works on any chart length or bar size (1-min, 5-min, etc)

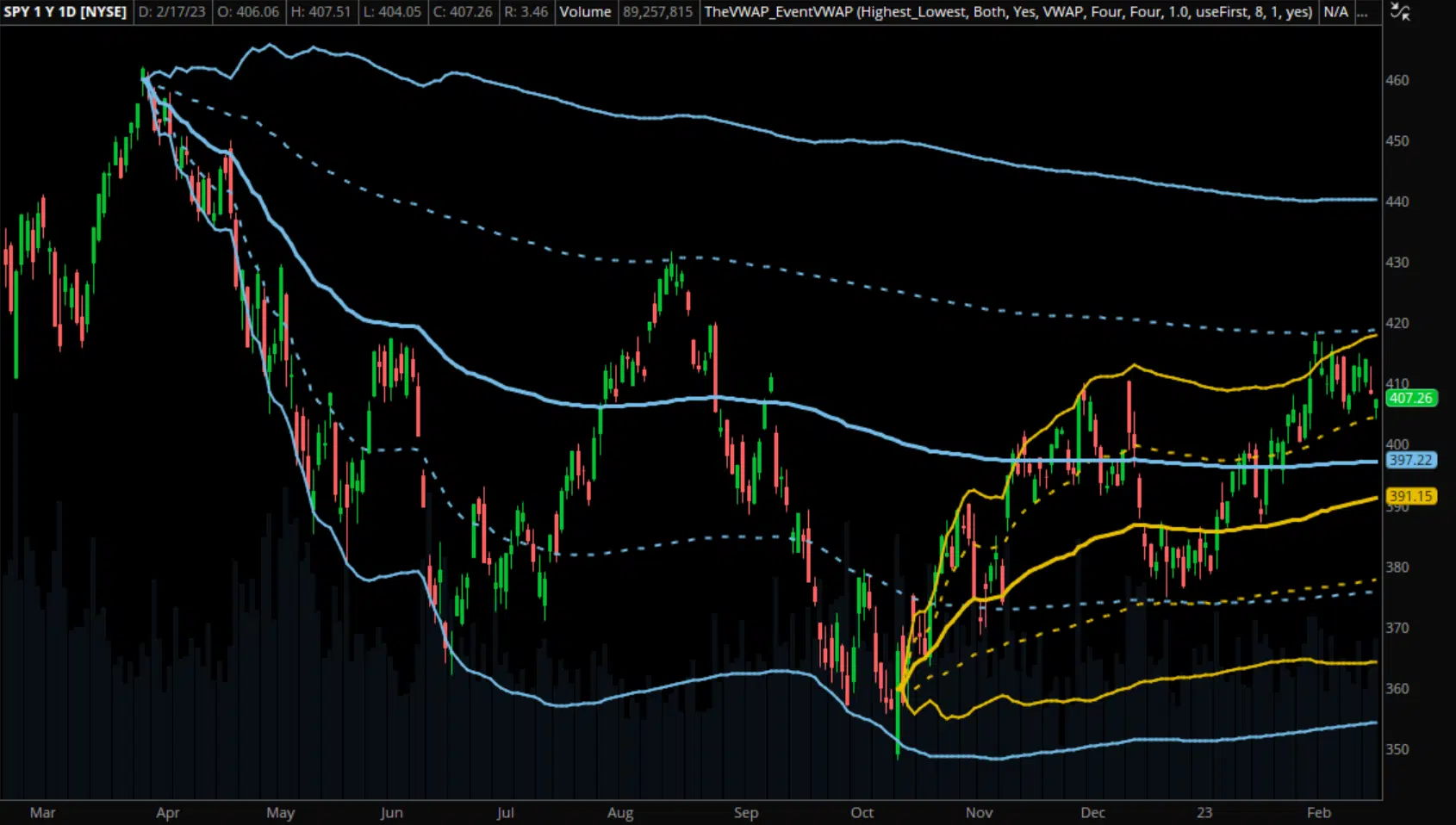

#6 — EventVWAP

EventVWAP is a specialized anchored VWAP indicator, built to automatically detect notable events in a

chart's history and launch VWAPs from those points.

It requires no manual date input from the user and instead provides a list of preset options to select

from — earnings, technical gaps, options expiries, etc.

Core features:

Presets for earnings, gaps, options expiries, and swing

Anchor up to four VWAPs of the same type at once

Optional standard deviation bands for all VWAPs

Adjustable gap threshold to qualify as anchor point

Get lifetime access to all six indicators for the price of three.

Platform Package — $225Frequently Asked Questions

Absolutely not. You'll have free lifetime access with no recurring fees, regardless of whether you sign up for VWAP On-Demand or purchase separately.

You'll be granted immediate access to our indicator portal, which contains download links for each indicator, tutorials, and import instructions.

Our indicator portal provides step-by-step instructions to help you add each indicator to your thinkorswim platform. And if needed, you're always welcome to reach out with questions.

We'll send you our "Intraday" indicator for free, plus a detailed tutorial.